The Leading Functions to Seek in a Secured Credit Card Singapore

The Leading Functions to Seek in a Secured Credit Card Singapore

Blog Article

Introducing the Opportunity: Can People Discharged From Bankruptcy Acquire Credit Report Cards?

Understanding the Influence of Insolvency

Upon declare insolvency, people are challenged with the considerable repercussions that permeate numerous aspects of their monetary lives. Insolvency can have a profound effect on one's debt rating, making it testing to gain access to credit or finances in the future. This economic tarnish can stick around on debt records for numerous years, impacting the person's capacity to secure beneficial rates of interest or economic possibilities. Furthermore, bankruptcy might lead to the loss of assets, as particular ownerships may require to be liquidated to repay financial institutions. The emotional toll of bankruptcy should not be ignored, as individuals might experience feelings of pity, guilt, and stress and anxiety due to their economic circumstance.

Moreover, personal bankruptcy can limit employment possibility, as some companies conduct debt checks as part of the employing procedure. This can pose an obstacle to people seeking new work leads or profession improvements. On the whole, the impact of insolvency expands beyond financial restraints, influencing different elements of an individual's life.

Factors Affecting Charge Card Authorization

Getting a bank card post-bankruptcy rests upon numerous vital variables that significantly affect the authorization procedure. One critical factor is the candidate's credit rating. Adhering to personal bankruptcy, people commonly have a low credit report due to the negative influence of the insolvency declaring. Credit score card firms commonly seek a credit history that demonstrates the candidate's capability to manage credit rating sensibly. One more essential factor to consider is the applicant's revenue. A steady income guarantees credit report card issuers of the person's capacity to make prompt payments. Furthermore, the length of time considering that the bankruptcy discharge plays a crucial role. The longer the duration post-discharge, the much more desirable the possibilities of approval, as it suggests economic stability and liable credit history behavior post-bankruptcy. Moreover, the kind of bank card being requested and the provider's specific requirements can also impact approval. By thoroughly considering these variables and taking actions to reconstruct credit scores post-bankruptcy, people can boost their prospects of obtaining a charge card and functioning in the direction of economic recovery.

Steps to Restore Credit After Bankruptcy

Rebuilding credit rating after personal bankruptcy requires a strategic approach focused on economic technique and consistent financial debt monitoring. One reliable approach is to acquire a safe debt card, where you transfer a specific amount as collateral to develop a credit history limitation. Additionally, consider becoming an accredited individual on a family participant's credit card or discovering credit-builder lendings to further enhance your credit rating.

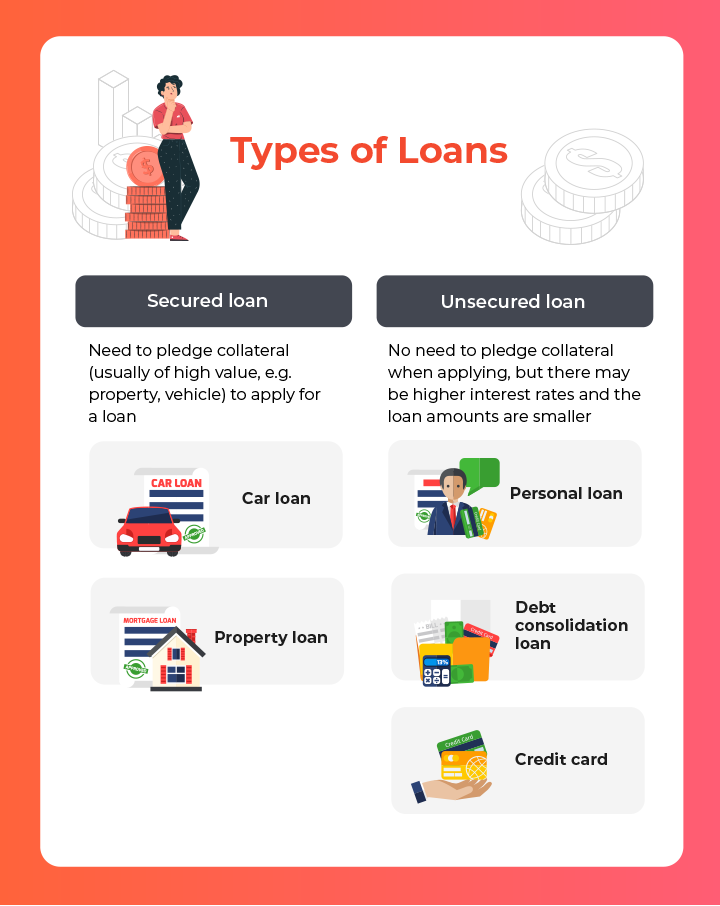

Safe Vs. Unsecured Credit History Cards

Following bankruptcy, people typically consider the selection between safeguarded and unsafe debt cards as they aim to restore their credit reliability and financial stability. Secured credit cards require a cash deposit that serves as collateral, normally equal to the credit score restriction approved. These cards are less complicated to get post-bankruptcy because the down payment decreases the threat for the provider. Nonetheless, they may have greater costs and interest rates compared to unsafe cards. On the other hand, unprotected credit scores cards do not call for a down payment but are harder to qualify for after bankruptcy. Companies assess the applicant's credit reliability and may provide reduced costs and rates of interest for those with a good economic standing. When deciding between both, people should weigh the advantages of much easier authorization with guaranteed cards versus the potential expenses, and take into consideration unsafe cards for their long-term address financial goals, as they can help reconstruct credit report without locking up funds in a deposit. Ultimately, the choice between protected and unsafe charge card must align with the individual's financial goals and ability to take care of credit scores sensibly.

Resources for Individuals Seeking Credit Report Restoring

For people aiming to improve their credit reliability post-bankruptcy, discovering offered resources is crucial to effectively navigating the credit rating restoring process. secured credit card singapore. One useful resource for individuals looking for credit score restoring is credit therapy agencies. These organizations provide economic education and learning, budgeting assistance, and customized credit score improvement plans. By dealing with Learn More Here a credit rating counselor, individuals can acquire insights into their credit score records, learn methods to enhance their credit rating, and receive guidance on managing their finances effectively.

One more practical source is credit history tracking services. These solutions allow individuals to maintain a close eye on their debt records, track any type of changes or mistakes, and spot possible indicators of identity burglary. By monitoring their debt consistently, individuals can proactively resolve any concerns that might guarantee and develop that their credit rating info is up to day and accurate.

Furthermore, online tools and resources such as credit history simulators, budgeting apps, and monetary proficiency sites can offer individuals with beneficial details and devices to help them in their credit scores rebuilding trip. secured credit card singapore. By leveraging these resources successfully, people released from bankruptcy can take meaningful steps in the direction of enhancing their debt health and protecting a better economic future

Final Thought

To conclude, individuals released from bankruptcy might have the opportunity to acquire credit cards by taking actions to rebuild their credit scores. Elements such as credit scores earnings, debt-to-income, and background proportion play a substantial function in credit history card authorization. By comprehending the impact of personal bankruptcy, picking between protected and unsecured bank card, and making use of resources for credit score rebuilding, people can improve their credit reliability and potentially obtain access to charge card.

By functioning with a credit therapist, people can get understandings right into their credit rating reports, discover techniques to enhance their credit report ratings, and get assistance on managing their finances efficiently. - secured credit card singapore

Report this page